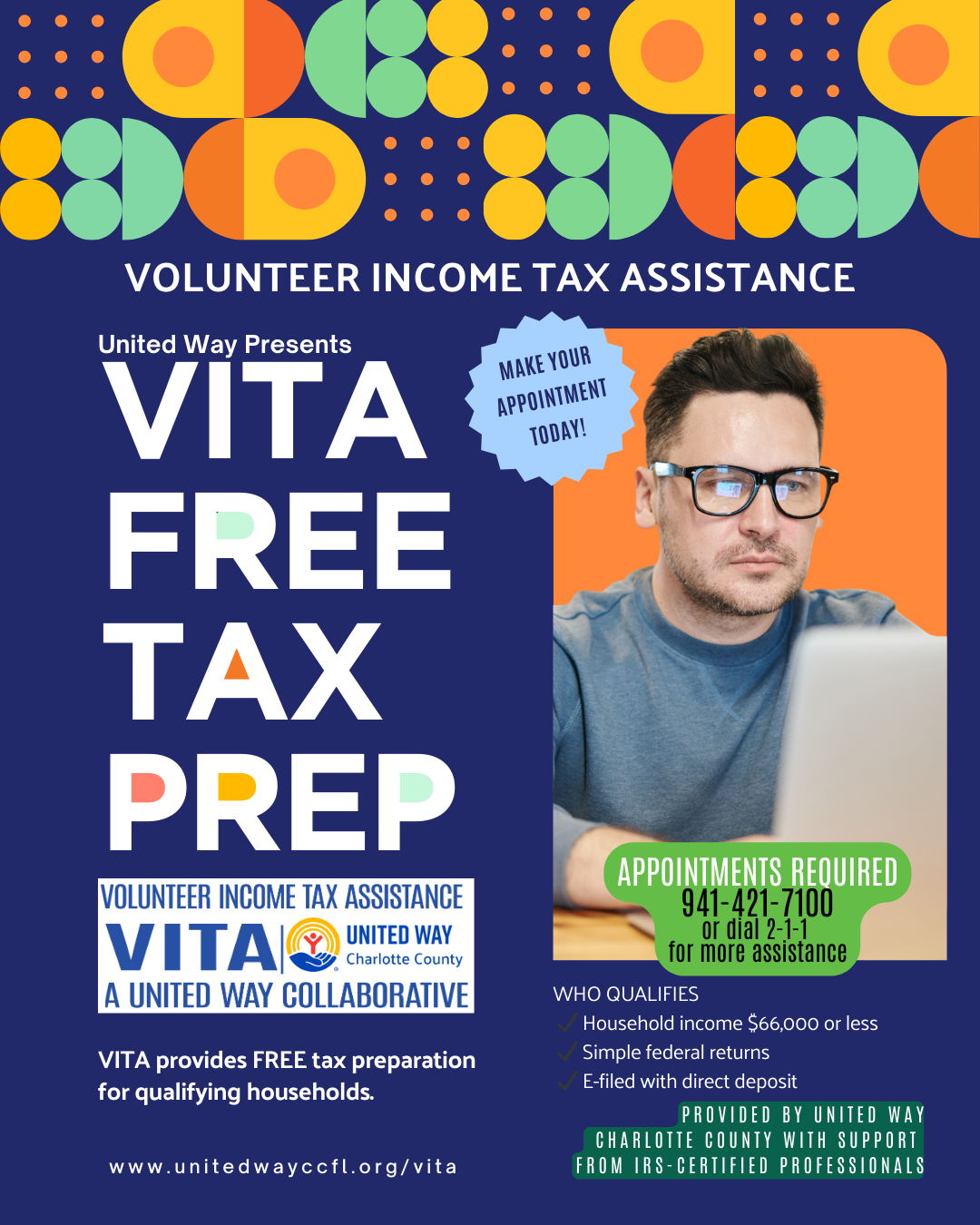

United Way’s Free Tax Preparation program helps low- to moderate-income households meet their basic needs and build financial assets. Residents who earn a household income of $66,000 or less can have their federal tax returns prepared, e-filed and direct deposited for FREE by United Way’s Volunteer Income Tax Assistance (VITA) program.

United Way IRS-certified volunteers who are passionate about taxes will prepare your return and determine if you are eligible for the Earned Income Tax Credit (EITC), Child Tax Credits, Childcare Credits, and/or Education Credits when you file.

We do simple returns. We cannot accept returns that have rental income or self-employment income at a loss, with expenses exceeding $35,000, or with employees. Please call to see if you qualify.

Appointments for the 2025 Tax Season are open now!

Choose an option that is right for you

- File Yourself - Have a simple tax return and a computer? You can file yourself for FREE. All you need is the AGI (Adjusted Gross Income) amount from last year’s return. Click to file with MyFreeTaxes.com

- Schedule an appointment at one of our VITA sites - We are taking appointments now. See the list of tax sites below.

ALL SITES ARE BY APPOINTMENT ONLY:

Please call 941-421-7100 or 2-1-1 (or 239-433-3900) for scheduling.

- Port Charlotte: Family Services Center, 21500 Gibralter Dr. | Tuesdays & Wednesdays

- Punta Gorda: New Life Church, 507 W. Marion Ave. | Mondays

Please leave a voicemail with your name, phone number, and preferred time to receive a call back in case our staff are busy attending to other calls.

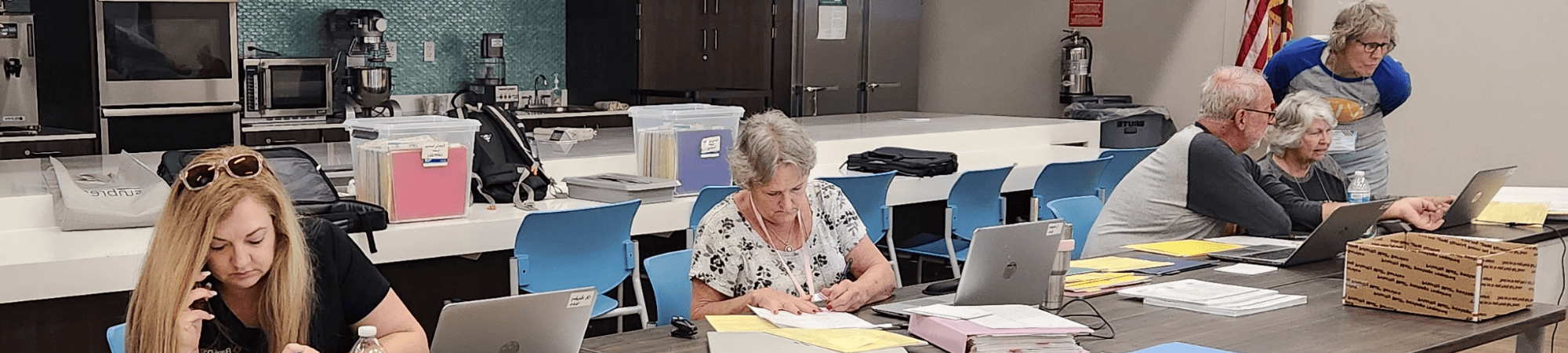

You can put the 'Volunteer' in Volunteer Income Tax Assistance

Volunteering for the Volunteer Income Tax Assistance (VITA) program is a fun and easy way to help others in our community. You don’t need to be a numbers-person to help, either! The software (a partnership between Tax-Slayer and the IRS) does all of the heavy lifting. Over 85% of our volunteers have had no prior experience in tax prep.

Through the VITA program, you can help hard-working individuals and families in our community take advantage of every credit and deduction they qualify for and reinvest their refunds back into Charlotte County.

Contact us at 941-627-3539 for more information or complete the volunteer application.

Volunteer Positions:

- Appointment Setters make phone calls to clients to schedule their time slot.

- Greeters welcome VITA clients to the site and ensure that they are prepared with all required documentation to meet with the tax preparer.

- Tax Preparers help individuals and families prepare their tax returns and ensure all eligible taxpayers receive their qualifying tax credits.

- Site Coordinators/Quality Reviewers manage the operations of the United Way VITA site, including volunteer staff and quality control.

These roles contribute to families’ financial stability every year. Behind every return, there is a story. Volunteers hear these stories and experience firsthand how they are making a difference every time they volunteer.

Thank you, Sponsors:

FREQUENTLY ASKED QUESTIONS

- Federal Photo IDs (If filing jointly, both spouses must be present WITH ID)

- Social Security cards and correct birthdates for all family members

- W-2 forms for all jobs worked during the current tax year

- All 1098 forms (for mortgage, higher education expenses, etc.)

- All 1099 & other income forms

- Amount of any income not reported on a statement

- Records of deductible/qualified expenses not shown on a statement

- A voided check and/or savings account number for direct deposit (encouraged)

- Childcare provider info (name, address, tax ID/social security number)

- Last year’s federal income tax return (encouraged)

Save time by completing the intake sheet and bringing it with you:

Form 13614-C (Rev. 5-2025) English

Form 13614-C (sp) (Rev. 5-2025) Spanish

Where is my REFUND?

VITA sites operated by United Way Lee, Hendry & Glades - Extended Season 2025